Single-Serve advancing but facing wide-ranging challenges

“The market for single-serve coffee continues to grow rapidly. There are opportunities aplenty say leading players in the market, but most also agree that the category has a range of challenges to address”

In its most recent financial announcement, about its results for the quarter ending 31st December 2013, Green Mountain Coffee Roasters (GMCR) said sales had grown by 4 per cent, a result it attributed to continuing demand for its Keurig brewing system.

The company’s President and CEO, Brian P Kelley, said: “We achieved record brewer volume, revenue and retail sell- through despite a challenging holiday season for many retailers, demonstrating the growing popularity of our Keurig brewing system among North American consumers. We believe these results will drive continued strong Keurig brewer installed base growth and future portion pack consumption.”

At about the same time, GMCR unveiled its next-generation Keurig, the Keurig Carafe, which will enable users to brew a single cup and a carafe using Keurig branded packs. The ‘K-Carafe’ capability for its Keurig 2.0 brewing system will be available for sale in the autumn of 2014. “Keurig brewer owners and non-owners alike told us the brewer functionality they wanted most was the ability to brew a single serving and a pot of coffee from one system, with Keurig speed, convenience and brand choice,” said Mr Kelley. “Our next generation Keurig 2.0 brewers will do just that.”

The market for single-serve coffee continues to grow rapidly. There are opportunities aplenty say leading players in the market, but most also agree that the category has a range of challenges to address.

Multi-cup Option

Mr Kelley explained that the innovation required to deliver the carafe functionality came from close collaboration of the company’s beverage and brewer engineering teams. “We made significant advancements in roasting and flavor extraction, thermodynamics, and mechanical and software design to ensure that our Keurig 2.0 brewing system will give consumers a perfect, consistent cup of high quality coffee at the touch of a button, whether they choose to brew a single serving, or choose to brew a carafe with our K-Carafe pack,” he said.

GMCR also recently announced a multi- year agreement with Krispy Kreme that will see Krispy Kreme coffee available in K-Cup packs for the Keurig brewing system. The companies plan to launch Krispy Kreme coffees, Smooth and Decaf, in K-Cup packs for Keurig brewers by the end of 2014. The new Krispy Kreme K-Cup packs will be available at Keurig. com and KrispyKreme.com, as well as participating Krispy Kreme shops, grocery, retail, and away-from-home channels throughout the US.

Lawsuit Targets Lock-out Function

The single-serve market has become a very litigious space in the last couple of years, with Nestlé Nespresso launching a series of, ultimately unsuccessful law suits against companies producing products that are compatible with its coffee brewers.

February saw TreeHouse Foods, and two wholly-owned subsidiaries, Bay Valley Foods and Sturm Foods, le a suit against Green Mountain Coffee Roasters and Keurig, accusing them of anticompetitive acts to unlawfully maintain a monopoly over the cups used in single-serve brewers. In its complaint, led in the US District Court for the Southern District of New York, TreeHouse asserts claims against Green Mountain for violation of federal antitrust laws, and state antitrust and unfair competition statutes and common law of the states of New York, Wisconsin and Illinois.

Specifically, the plaintiffs assert that various exclusionary agreements between Green Mountain and various suppliers and distributors are designed to maintain Green Mountain’s monopoly in the single- cup market after the expiration of Green Mountain’s patents.

Furthermore, Green Mountain has announced that its Keurig 2.0 brewer will contain what TreeHouse described as “anticompetitive lock-out technology” that will prevent the Keurig 2.0 brewers from functioning with cups supplied by unlicensed competitors. TreeHouse asserts that these actions are “an attempt to eliminate consumer choice and to coerce Keurig 2.0 brewer owners into purchasing only Green Mountain owned or licensed K-cups.”

Green Mountain has announced that its Keurig 2.0 brewer, to be launched later this year, will contain what TreeHouse described as “anticompetitive lock-out technology” that will prevent the Keurig 2.0 brewers from functioning with cups supplied by unlicensed competitors. TreeHouse asserts that these actions are “an attempt to eliminate consumer choice and to coerce Keurig 2.0 brewer owners into purchasing only Green Mountain owned or licensed K-cups.”

Green Mountain has announced that its Keurig 2.0 brewer, to be launched later this year, will contain what TreeHouse described as “anticompetitive lock-out technology.”

In addition, Green Mountain has announced plans to eliminate the current line-up of K-cup brewers, which function with competitive cups, to exclude competition and force consumers to purchase higher-priced Green Mountain cups.

TreeHouse’s lawsuit maintains that any supposed consumer bene ts from the new technology are more than outweighed by the harm to competition and consumers by eliminating choice and forcing them to pay higher prices for Green Mountain cups. Sam K Reed, Chairman, President and Chief Executive Officer of TreeHouse Foods, said: “We reluctantly brought this law suit not just for ourselves, but for consumers and other companies that similarly encounter anticompetitive practices that violate the law. We are seeking free and open competition on the merits to bring our customers high quality and innovative products at better prices. A favorable ruling for TreeHouse and our subsidiary businesses will prove beneficial to the entire spectrum of consumers, retailers and suppliers.

Nespresso “Performing Strongly”

Responding to questions from C&CI, the other leading player in the single serve market, Nespresso, said it had “performed strongly in 2013, delivering growth in its core European markets and accelerating in the Americas.

“The portioned coffee segment is very dynamic and the fastest growing segment of the global coffee market,” said the company. “According to Nielsen data from June 2013, the portioned coffee category continues to grow both in terms of volume and value (5.6 per cent volume, 16.5 per cent value across 26 markets.). We have demonstrated that we are well positioned to capitalize on this and bene t from increased consumer awareness.

Premium Experiences

“What we have seen is that as tastes evolve, more and more consumers are looking for high quality coffee experiences. They also want to learn more about the coffee they drink. Consumers come from being coffee drinkers to coffee connoisseurs. People increasingly look for premium experiences and Nespresso is well-positioned to cater to that.

“Today, we are competing against about 130 different product offerings in the portioned coffee segment around the world, including 90 that claim compatibility with Nespresso machines. Despite the presence of generic capsules,” said the company, “consumers continue to choose Nespresso in both its established markets in Europe and in its developing markets across the world.

“Our direct-to-consumer business model, with our extensive retail network, 24/7 phone line and e-commerce platform, is a clear distinction to the crowded supermarket environment, where our competitors are increasingly forced to compete against one another for shelf space. We are con dent that this unique route to market, combined with our total consumer offering will continue to earn the loyalty of our Club Members and new consumers worldwide.”

Manufacturers Benefit from Fast Pace of Growth

Attention in the single-serve market has tended to focus on the industry leaders such as Keurig and Nestlé Nespresso, but a host of companies in the supply chain for single serve coffee are also doing very well out of it. C&CI spoke to a number of them, including Pod Pack, Paci c Bag, Glatfelter and MPE in the US, and Rychiger and IMA Industries in Europe.

Pod Pack is a coffee co-packer that specializes in private label and national branding for ‘soft’ pods with a focus on single-cup brewing solutions for hospitality, foodservice, OCS, and homes. Asked what it believes are the key drivers in the single-serve market, the company said: “We think that Green Mountain/Keurig have done a great job Quality is the biggest issue. Second is the cost of a cup of coffee, although consumers haven’t hesitated about paying US$0.65 per cup, which equates to over US$30 per pound for single cup of introducing coffee consumers to the convenience of the single-cup brewing concept. We believe that Keurig convinced office consumers of the benefits of convenience and variety (of the Keurig brewing system) at work. These same consumers have begun to demand the same benefits at home.”

Asked what challenges the single- serve market faced, Pod Pack said it believed that single-cup consumers are looking for a significantly higher quality, better tasting cup of coffee. “But you have to understand that they are willing to sacrifice quality for convenience. The challenge is to communicate ways that they can have a higher quality, better tasting cup of coffee and still brew one cup at a time.”

Cost is an Issue

Asked what the biggest issues are that need to be addressed, such as environmental concerns about packaging/recyclability, Pod Pack said: “Quality is the biggest issue. Second is the cost of a cup of coffee, although consumers haven’t hesitated about paying US$0.65 per cup, which equates to over US$30 per pound for single cup. Some of them probably justify it by comparing the cup price to ordering coffee at Starbucks and other coffee houses.

“The third issue is throwing plastic in the land ll. We notice people feel really guilty when you point out that 30 million plastic K-Cups go into the land fills every day, but they aren’t really putting much effort into being ‘green’ when it is convenient.

On the question of unlicensed/ copycat pods, Pod Pack said the issue was pretty simple. “Keurig is having a hard time challenging the unlicensed copycats and they aren’t winning in the court systems thus far. We don’t think you should restrict competition. A free market is always better. In the free market, sooner or later, someone other than Keurig will address the quality, cost, and green issues. Keurig did have a 20 year head start.”

Consumers will Determine what Happens

In recent months some analysts have suggested that the rate of growth in single- serve is slowing, but Pod Pack said it did not agree. The company feels that there is plenty of growth left in the US on the West Coast, Midwest, Southeast, and Southwest. “These areas are still underdeveloped. There is further growth potential in Canada and possibly Europe,” it said, noting that, right now, Keurig machines are most in demand in the US, because that is the machine that is most familiar to consumers.

Questioned about whether it expected pods or capsules to be most popular with consumers in future, the company said capsules as are winning today. “The future depends on what consumers need or what they do. If consumers become more concerned about the environment and are willing to put more effort into being green, then capsules are going to be in trouble,” said the company.

Queried about whether single-serve is actually increasing the amount of coffee drunk or replacing other forms of consumption, Pod Pack said: “That is a good question. Less waste will probably reduce the overall amount of coffee drunk, but there is a good chance that with single-cup, consumers are using more coffee to brew a cup of coffee, and they may be drinking more coffee, because of the convenience. This would increase consumption.”

Environmental Concerns

Rychiger produces packaging machines for coffee capsules. As of today the company supplies packaging machines for all of the leading coffee capsule systems. Asked what it attributes the fast growth of the single serve market to, Marius Olszewski, VP of Sales at Rychiger also highlighted ease of use and quality. He agreed that the biggest issue is environmental, and the fact that only some of the packaging materials can be recycled. “In different countries those issues are addressed in different ways,” he said. “Recently, some interesting packaging industry initiatives have been launched, aimed at development of compostable single serve cup cartridges. Balancing environmental concerns with a need to package coffee and other beverages into hermetically sealed protective containers is a big challenge, but I am convinced that in the future single serve cartridges will be fully sustainable.

Mr Olszewski said he agreed that the explosive rate of growth of single-serve in Europe and the US certainly is slowing to a degree, due to market saturation, but noted that as tea and other beverages, such as Cocoa Cola and soda became available in single serve format growth rates could pick up again.

“Keurig is having a hard time challenging the unlicensed copycats and they aren’t winning in the court system thus far. We don’t think you should restrict competition.”

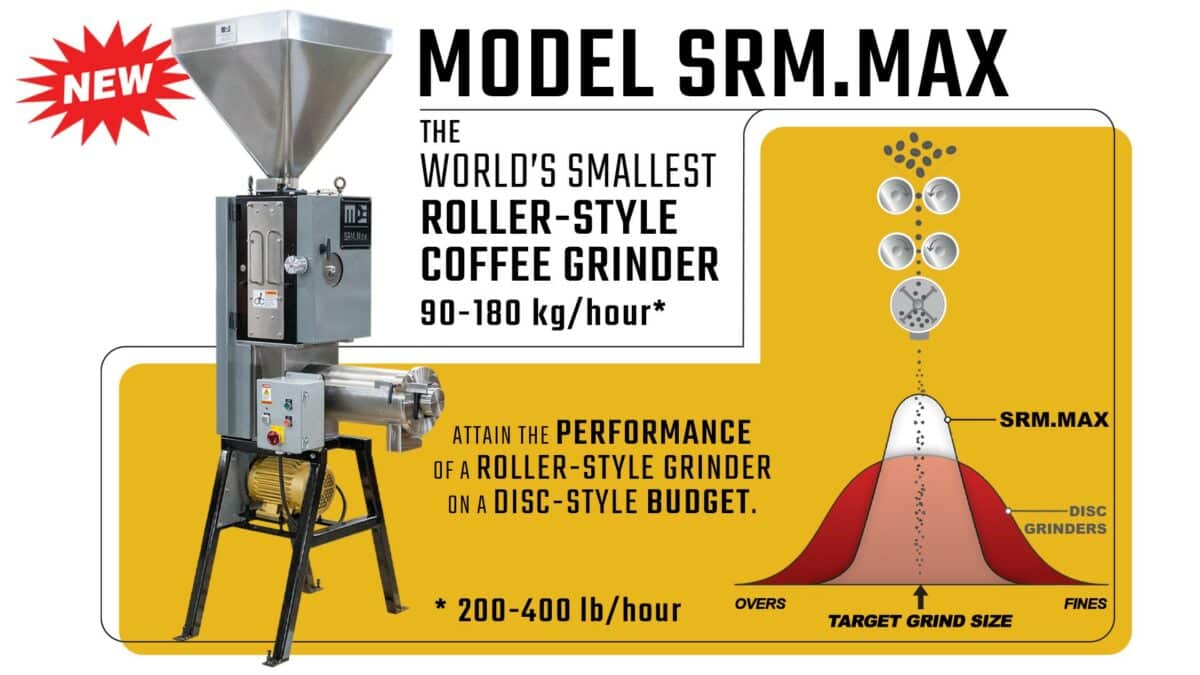

Regarding the rate of growth of the single-serve market, US-based MPE, which makes roller-style grinders to serve the single-serve market, told C&CI that, even if the rate of growth is slowing it would continue to be “considerable” for many years to come. In the US, it said, the rate of growth of capsules has dwarfed that of pods over the last few years, “and we see nothing that would change that dynamic.”

Another US-based company, Paci c Bag Inc, which offers single-serve equipment, cups, lid stock and stock bags to the specialty coffee market, said the largest challenge in the single-serve market right now is “plunging prices” and “the enormous number of people” jumping into the market. “In our opinion,”

said Paci c Bag, “this will continue to drive prices down as the larger companies fight for retail shelf space. Another significant issue for the single-serve market is waste. The Upshot cup, distributed by PBideas, is a step in the right direction. It is recyclable within certain constraints. There are not any immediate solutions, but enormous effort is being made to identify a way to reduce of waste.”

Patent Expiry Opened Floodgates

“Expiration of the Keurig patent on K-cups opened the floodgates for new products and knock-off cups coming into the market. The genie is out of the bottle,” said Paci c Bag. “In our opinion, copy-cat or knock-off products will continue to flood the market for the foreseeable future. Knock-off cups offer low quality, low cost options; other products will offer high quality alternatives to Keurig. In addition, there are many companies offering knock-off home brewing equipment, which will further complicate the convenience of the at home market.”

Market Saturation

Asked about growth rates, Paci c Bag said: “Yes. The single-serve cup market will have a ceiling. We believe the supermarket retail shelf is approaching that ceiling. In addition, existing capacity and capacity coming online will, in opinion, outstrip the demand.”

“We believe Keurig will be a part of the coffee landscape for many years to come… (but) price sensitive consumers think the cost is too high. We think this will inhibit market growth at the mass market level, while cup quality will be an issue in the specialty market. The specialty coffee market has a strong customer base for traditional, whole bean and ground coffee, where cup quality is vital – all indications are that this will remain strong. Traditional commodity roast and ground coffee will always have an appeal due to its price competitiveness.”

A spokesperson for US-based Glatfelter, which produces beverage ltration papers for single-serve applications such as hard and soft pods as well as capsules, agreed with the companies quoted above about the reasons for the popularity of single serve. “People

are looking to experience the great variety of avours at home that usually only out-of-home consumption, for example at Starbucks or Dunking Donuts, would offer,” the company said. “Environmental impact is an obvious concern.” Asked where it expects growth will come from in the future, it identi ed Brazil as a huge coffee drinking country, and traditional tea-drinking markets like the UK, Russia and China in addition to India.